Alabama woman guilty of conspiring to fabricate tax returns, collect more than $1 million fraudulently

Published 10:30 am Monday, February 10, 2020

Following a three-day bench trial, a Birmingham woman was convicted on charges of conspiracy to commit mail and wire fraud and intimidating a witness through an elaborate and fraudulent tax return scheme, announced U.S. Attorney Jay E. Town and IRS Criminal Investigation Special Agent in Charge Andrew M. Thornton, Jr.

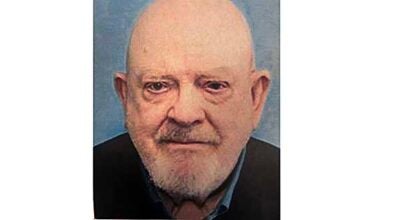

After three days of testimony, U.S. District Court Judge R. David Proctor convicted Quincetta Yvonne Cargill, 48, of one count of conspiracy to commit mail and wire fraud and one count of witness tampering. Cargill represented herself and also took the stand to testify.

“This case was about greed at the expense of too many,” Town said. “The finding of guilt for this individual should forewarn anyone that would commit fraud on the taxpayers by filing false tax returns will be prosecuted to the fullest extent. Thanks to the hard work of the prosecutors and agents the defendant has been brought to justice.”

“Individuals who commit refund fraud and identity theft of this magnitude and with this degree of trickery, dishonesty and deceit, deserve to be punished to the fullest extent of the law,” Thornton said. “IRS Criminal Investigation, along with our law enforcement partners and the United States Attorney’s Office, remain vigilant in identifying, investigating and prosecuting those individuals who seek to willfully defraud the United States Treasury and blatantly disregard the victims of their schemes.”

Evidence at trial, including witness testimony, bank records, and IRS tax returns, proved that Cargill obtained the names, dates of birth, and social security numbers of individuals, told them she was submitting their information for a federal grant program, and instead caused fraudulent tax returns to be filed with their information.

Cargill then directed others to open bank accounts, and used her own bank accounts, to receive tax refund checks from those fraudulently filed returns. In total, Cargill and her co-conspirators obtained more that $1 million from refunds from fraudulent tax returns.

Evidence at trial also proved that Cargill attempted to intimidate a witness in her case by sending information about the witness and their potential testimony to members of a motorcycle club, in order to influence or prevent that witness from testifying at trial.

The maximum penalty for conspiracy to commit mail and wire fraud is 20 years in prison and a $250,000 fine. The maximum penalty for witness tampering is 20 years in prison and a $250,000 fine.